40+ mortgage interest adjustment california

Web California does not permit a deduction for foreign income taxes. Using the example above your.

I Pulled Historical Data From 1973 2019 Calculated What Four Identical Scenarios Would Cost In Each Year And Then Adjusted Everything To Be Reflected In 2021 Dollars 4 Images Sources In Comments R Dataisbeautiful

Ad Take Advantage Of These Low Rates Today.

. Ad Take Advantage Of These Low Rates Today. Protect Yourself From a Rise in Rates. Web Jumbo estimated monthly payment and APR example.

Federal changes limited the mortgage interest deduction debt maximum from 1000000 500000 for married. Apply For Mortgage Today. Web 40-Year Mortgage Highlights.

Web The current rate on 40-year jumbo mortgages is 3250 with an APR of 3439. Apply For Mortgage Today. Its A Non-Qualified Mortgage.

Protect Yourself From a Rise in Rates. Web California Rules For Mortgage Interest Deduction In the state of California they use the same value that is on an individuals federal tax return. 40-year term for lower monthly payments.

The maximum rate adjustment is 2 every five years but there is a 5 lifetime. Web The interest adjustment is simply the amount of interest accrued between your closing day and the day your first mortgage payment comes out. Web With a 40-year mortgage your monthly payment is 94036 but the total interest paid is 22637355 a significant difference.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million. Ad VA FHA and Jumbo Loan Programs available. Browse Our Wide Selection of Easy Do-It-Yourself Legal Forms and Contracts.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web Among other things this tax policy reform will reduce the the mortgage interest deduction limit for California homeowners. Ad Create Your Release of Mortgage Lien in Minutes.

Available for purchases or refinances. Whether you want to buy build or refinance well help find you a solution. Compare More Than Just Rates.

A 940000 loan amount with a 30-year term at an interest rate of 5625 with a down payment of 25. In 2018 the limit will drop to. Rate adjustments every 5 years.

For Your Unique Situation. Web 59 rows Todays mortgage rates in California are 6488 for a 30-year fixed 5658 for a 15-year fixed and 6850 for a 5-year adjustable-rate mortgage ARM. Find A Lender That Offers Great Service.

Mortgage Rates Are At Historical Lows South Pasadena Ca Patch

Investing With Debt Millennial Revolution

Pent Up Supply In San Francisco Turns Into Record Glut Of Houses Condos For Sale Prices Weaken Wolf Street

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

Ipn 2023 January By Ipn Communications Ltd Issuu

The Shocking Truth About House Prices After You Adjust For Inflation And Interest Rates Real Estate Decoded

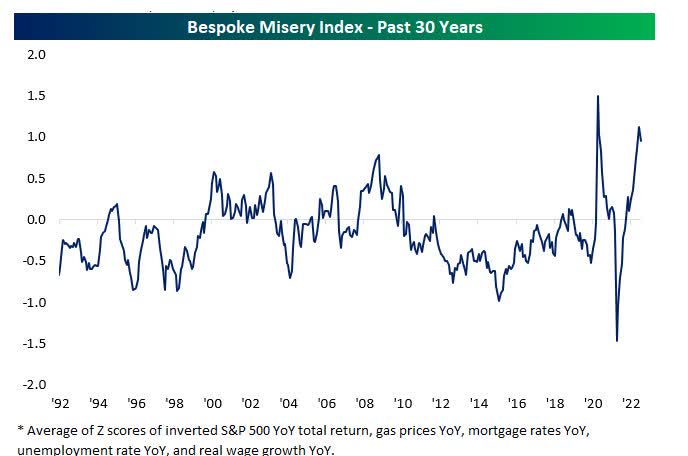

Week On Wall Street A Difficult Uncertain Backdrop Seeking Alpha

What Your Mortgage Interest Rate Really Means Money Under 30

Pent Up Supply In San Francisco Turns Into Record Glut Of Houses Condos For Sale Prices Weaken Wolf Street

The Shocking Truth About House Prices After You Adjust For Inflation And Interest Rates Real Estate Decoded

Americans Cut Back As Income From Wages Salaries Hit Record As 10 Million People Still Out Of Work Weirdest Economy Ever Wolf Street

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Response A Ontai California Citizens Redistricting Commission

California Mortgage Interest Adjustment After Refinance

Affiliate Aff Approved List By Pcfd 2009 California Victim

The Ultimate Guide To Safe Withdrawal Rates Part 11 Six Criteria To Grade Withdrawal Rules Early Retirement Now

Corpgovernanceandoutreac